Beauty Retail: Eat or Be Eaten

Amazon was ugly. TikTok was silly. And yet… they’re devouring the beauty aisle.

“Amazon will never be big in beauty. The interface is ugly, no one discovers there. It’s just for toys, books, and commodities. They don’t get brands. ICK. I’d never put my brand on Amazon. I have taste.”

— heard in beauty boardrooms, circa 2019

“There’s no way prestige brands will do real business on TikTok. It’s just a traffic channel. Who would trust a dancing app? Kids don’t have credit cards. Let’s focus on DTC, where we control everything.”

— same boardroom, 2022

Ahem.

Did you hear that loud throat clearing?

Because here we are in 2025:

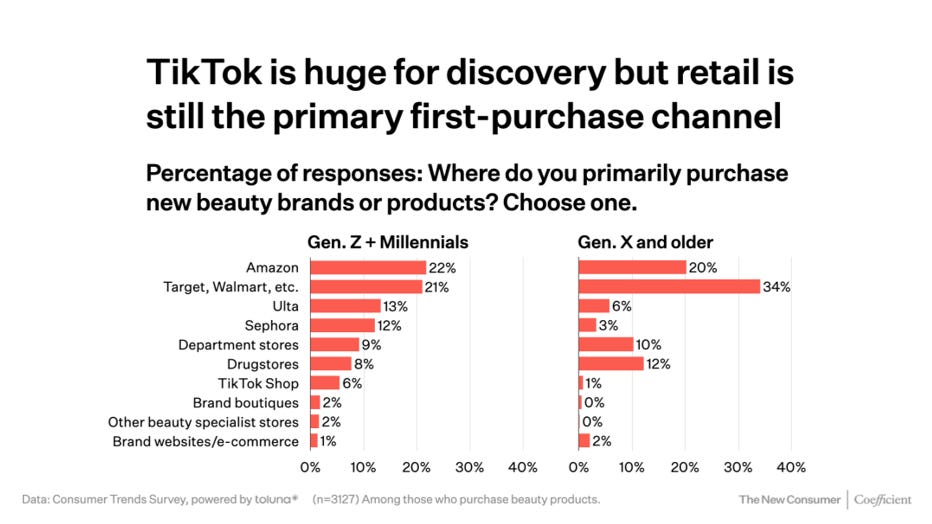

TikTok Shop is bigger than Sephora — and it’s coming for Ulta.

TikTok may still be in diapers, but it’s sprinting like a baby robot possessed. Usain Bolt fast. Coming straight for a slice of the beauty oligopoly — the small circle of retailers who gatekeep access to 5,000+ beauty brands in the U.S.

And Amazon? It’s no longer gauche. Brands are lining up. Why? Because consumers are creatures of habit. Convenience wins. And while some still clutch pearls over trust, most don’t care. Amazon is frictionless, familiar, and everywhere.

So what happens to the incumbents?

They’ll start by checking their retention numbers. Even with loyalty points and Prime-like perks, TikTok’s retention stats sting. Badly. No points. Just well-pointed eyeballs.

We’ve all discovered something on TikTok. You may not have bought it.

Maybe you hesitated. Maybe you bought it somewhere else.

But then — that irresistible promo. That “only on TikTok” discount.

You tap. You buy. It ships fast. The dopamine hits.

And just like that, another flywheel turns.

Especially for beauty products under $38, and this wheel’s not slowing down.

Let’s get to the main event: Beauty Retail: Eat or Be Eaten.

Consumer demand is softening. Tariffs are looming. And survival mode has kicked in.

Every retailer is fighting for their slice of the beauty pie.

We’re watching a real-time reckoning:

Sephora and Ulta still have powerful moats with their in-store experience, and loyalty programs. But is that enough?

We may be approaching a tipping point:

Consumers discover on TikTok, repurchase on Amazon.

Could that be the future? Maybe.

But don’t expect Sephora and Ulta to quietly hand over the gloss.

Let’s talk feelings.

According to the data:

Younger consumers are excited, happy, and overwhelmed.

Older consumers are overwhelmed, happy, and excited.

Same emotions. Different order.

And that matters.

Older shoppers have been around longer. They've seen trends come and go. They've been over-marketed to. That’s why their overwhelm feels heavier — more weary, less wide-eyed.

So, who wins this fight? Too early to tell. But when the lion roars, the bear charges, the fox schemes, and the hyena circles, there’s one creature sitting quietly above it all.

The owl.

It watches. It listens. It waits.

And when the moment is right, it moves

not with force, but with clarity.

In the wild, the loudest don’t always win.

The wisest do.